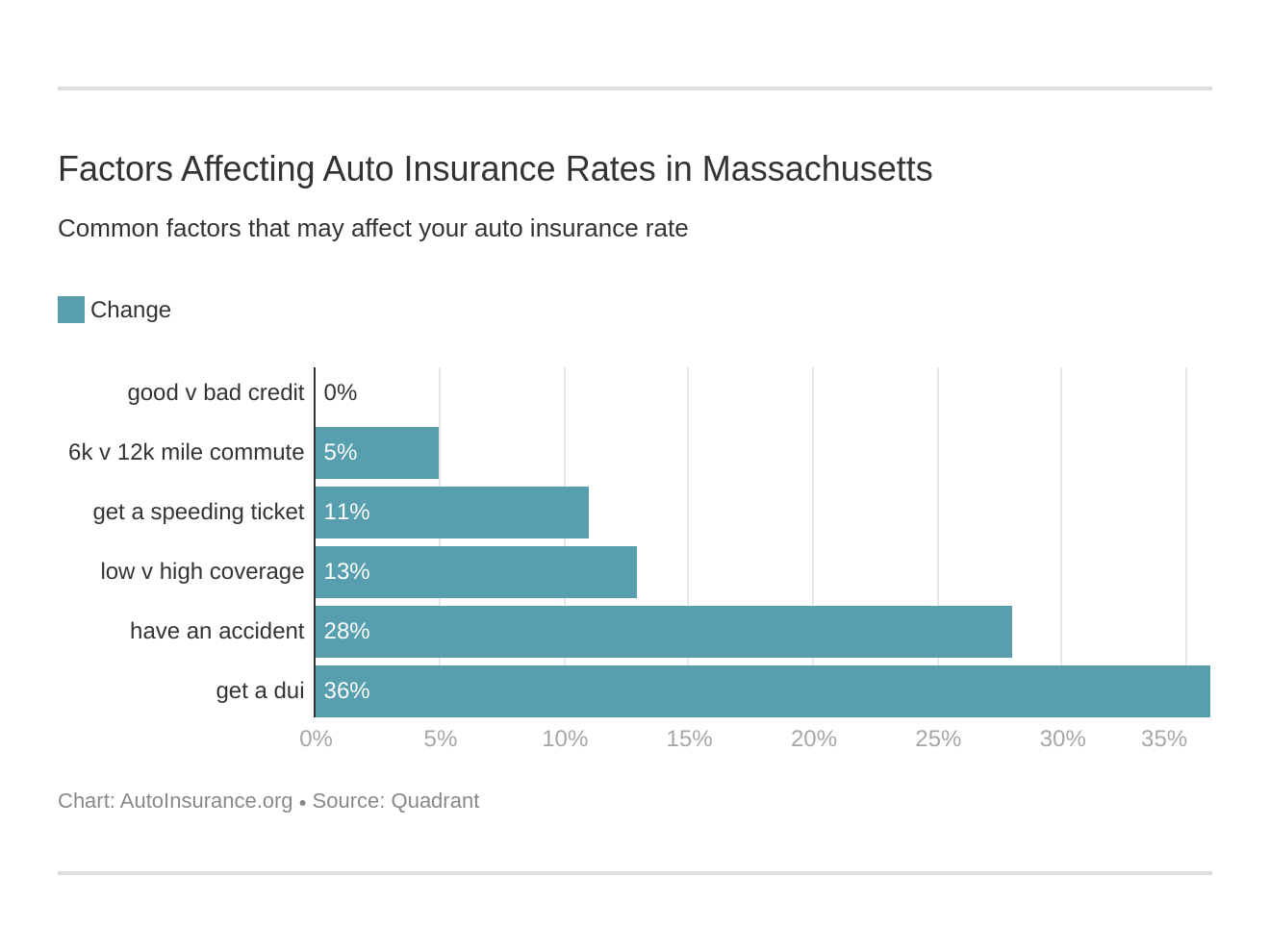

As a result anybody operating a vehicle on the states public roads is required to have a car insurance policy in place before doing so. Insurance companies are also prohibited from denying you automobile insurance based on any credit information contained in a consumer report that is obtained from a credit reporting agency.

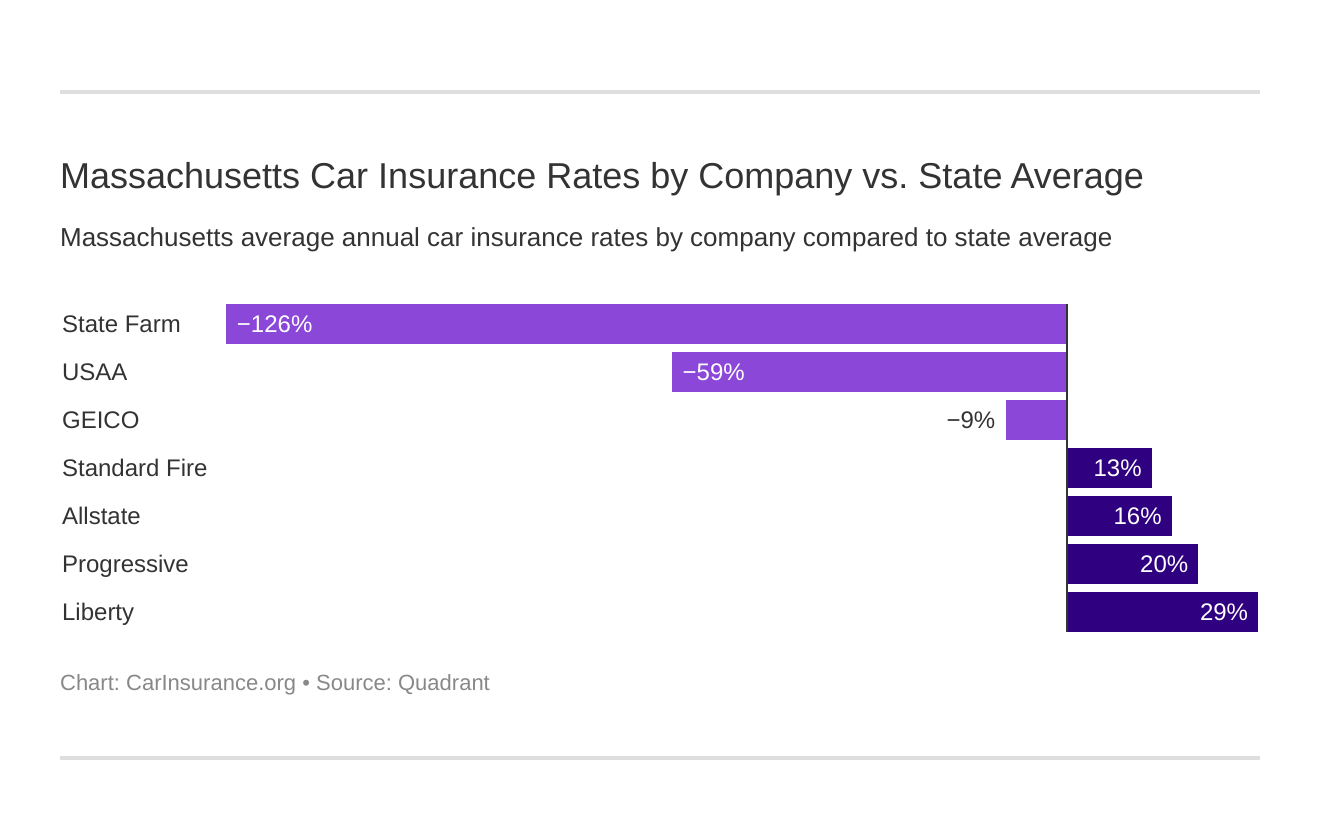

Massachusetts Car Insurance Rates Companies Carinsurance Org

All drivers must carry 20000 bodily injury coverage per person and 40000 per accident.

Car insurance laws in massachusetts. Car insurance is a must in Massachusetts and the state sets a number of mandatory coverage types and minimum limits. Read on to learn more about Massachusettss no-fault car insurance system the. You may also buy a variety of Optional Coverages to suit your needs.

You should also list any person who occasionally drives your car. 113A Motor vehicle liability policies. Massachusetts car insurance laws require all drivers to carry a minimum level of auto insurance coverage when driving or parking on public roads.

Any person who operates a licensed vehicle in Massachusetts must purchase the required minimum auto insurance coverage as directed by the Division of Insurance guidelines. 4E Prohibits use of credit information in issuing or renewing auto insurance. Even though carrying car insurance is the law in Massachusetts car accidents involving an uninsured driver happen all too often.

Under a no-fault system you lose some of your rights to sue for. Some insurance companies may consider paying on a case by case basis. In order to register a car in Massachusetts you must have automobile insurance.

Nearly 33000 crashes involved at least one injury and 323 people were killed in car accidents. Massachusetts is also a no-fault car insurance state which means your options for pursuing a claim are often limited when youre injured in a car accident. Drivers with a car loan must also have additional insurance policies.

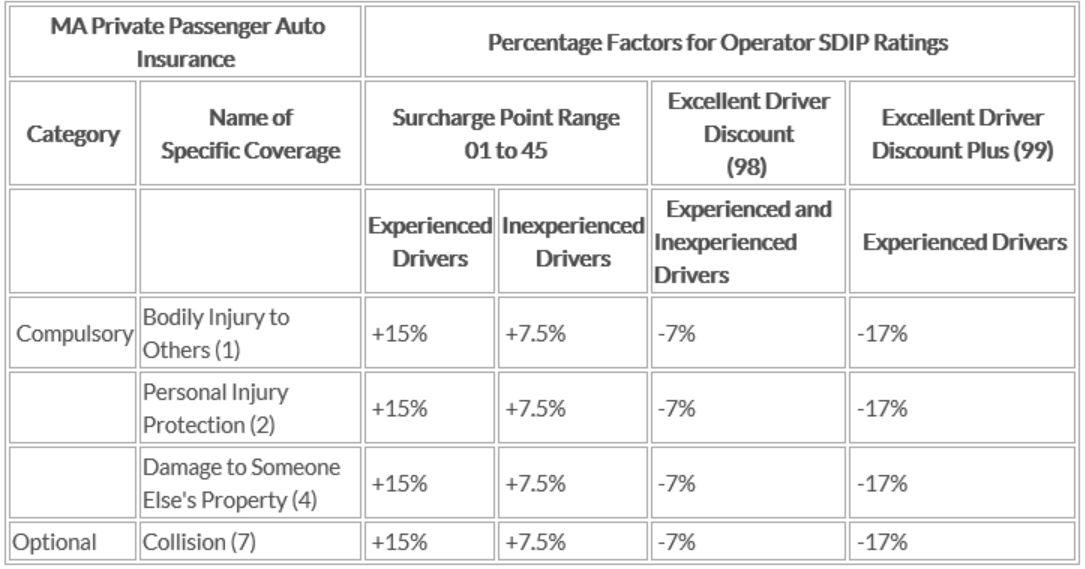

By law you must purchase four coverages called Compulsory or Mandatory Coverages in at least minimum amounts required by law and in higher amounts if you choose to do so. You have the option of purchasing additional coverage beyond the mandatory minimum. MGL c175 Insurance.

Options to purchase policies or bonds. That means your insurance will pay your injury claims up to a specified limit regardless of who caused the accident. There are four types of mandatory car insurance coverage in Massachusetts for all private-passenger vehicles.

At this time Massachusetts does not have a law requiring insurance companies to pay diminished value claims. Proof of insurance must be carried at all times while driving and must be shown to law enforcement officials when requested. In order to protect yourself in this situation Massachusetts requires you to carry uninsured motorist insurance coverage.

Motorists must provide proof of insurance. Your auto insurance policy must list all licensed drivers living in your household who are related to you by blood marriage or adoption including drivers already covered by their own insurance policies. Like other states the purpose of these laws is to make sure theres some sort of recourse for parties injured by the.

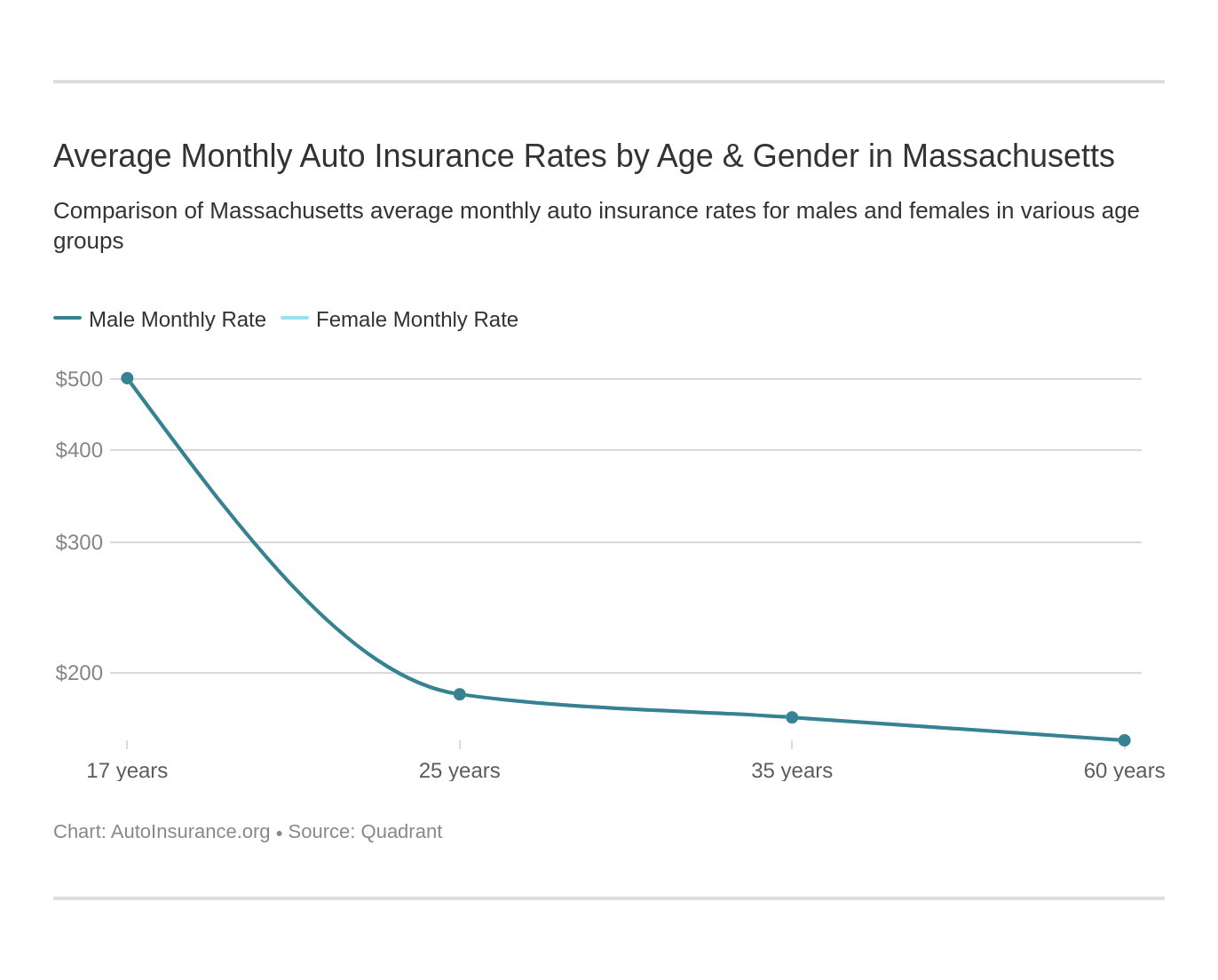

Massachusetts prohibits insurance companies from denying you automobile insurance based on your gender race creed national origin marital status religion age occupation income principal place of garaging your car education and homeownership. Insurance companies can also refuse to pay based upon the policy language under Part 7 Collision. Typically glass damage is covered by the comprehensive portion of your policy.

20000 for any one persons injuries in a crash 40000 for each accident where more than one person is injured 5000 for property damage in each accident and. Vehicle owners in Massachusetts are required to have an auto insurance policy that provides at the very least the following coverage. Failure to do so can result in severe penalties that may include monetary fines and jail time.

Massachusetts sits right in the pack of 49 other states with regards to enacting minimum car insurance coverage requirements on drivers. Massachusetts Car Insurance Laws Auto insurance in Massachusetts is legally required to operate a vehicle and is necessary to register a car in MA. In 2019 there were 140470 car accidents reported by the Massachusetts Department of Transportation.

This is true whether you are filing a claim under your own policy or if another driver is at fault for damaging your car. While the policy only requires you to list customary operators insurers often interpret this term broadly and some require that you list. In addition motorist need 8000 personal injury protection PIP coverage per person per accident as well as 5000 property damage liability coverage per accident.

Mandatory coverage may also be called compulsory coverage. There are four insurance coverages that are compulsory in Massachusetts. Vehicle owners in Massachusetts are required by law to maintain certain minimum levels of car insurance coverage on any vehicle registered and driven in the state.

Under Massachusetts law car insurance companies are required to offer windshield replacement coverage as part of their policies with either a zero deductible or a 100 deductible option. Notice of reduced or eliminated coverages. Auto insurance requirements in Massachusetts Massachusetts law states that all drivers must carry a minimum amount of car insurance coverage before getting behind the wheel.

Massachusetts state law requires you to carry a minimum amount of car insurance. Massachusetts is a no-fault state.

Best Car Insurance Companies Of August 2021 Forbes Advisor

![]()

Massachusetts Auto Insurance Get Free Insurance Quotes And Save

Massachusetts Car Insurance Rates Companies Carinsurance Org

What Is No Fault Insurance And How Does It Work Quotewizard

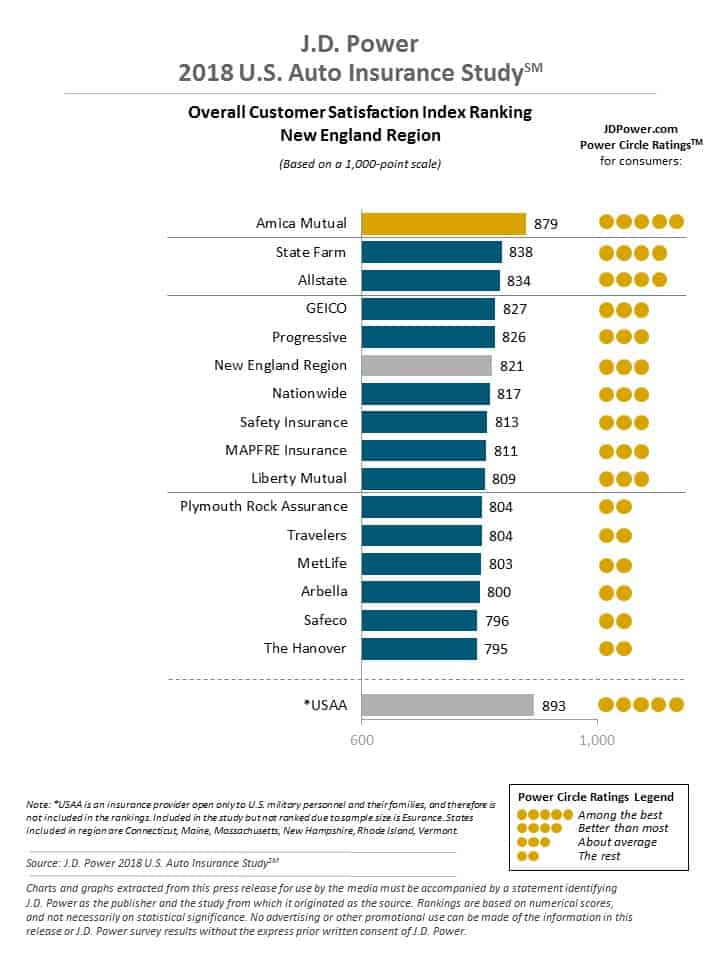

Massachusetts Auto Insurance Quotes Definitive Coverage Guide Autoinsurance Org

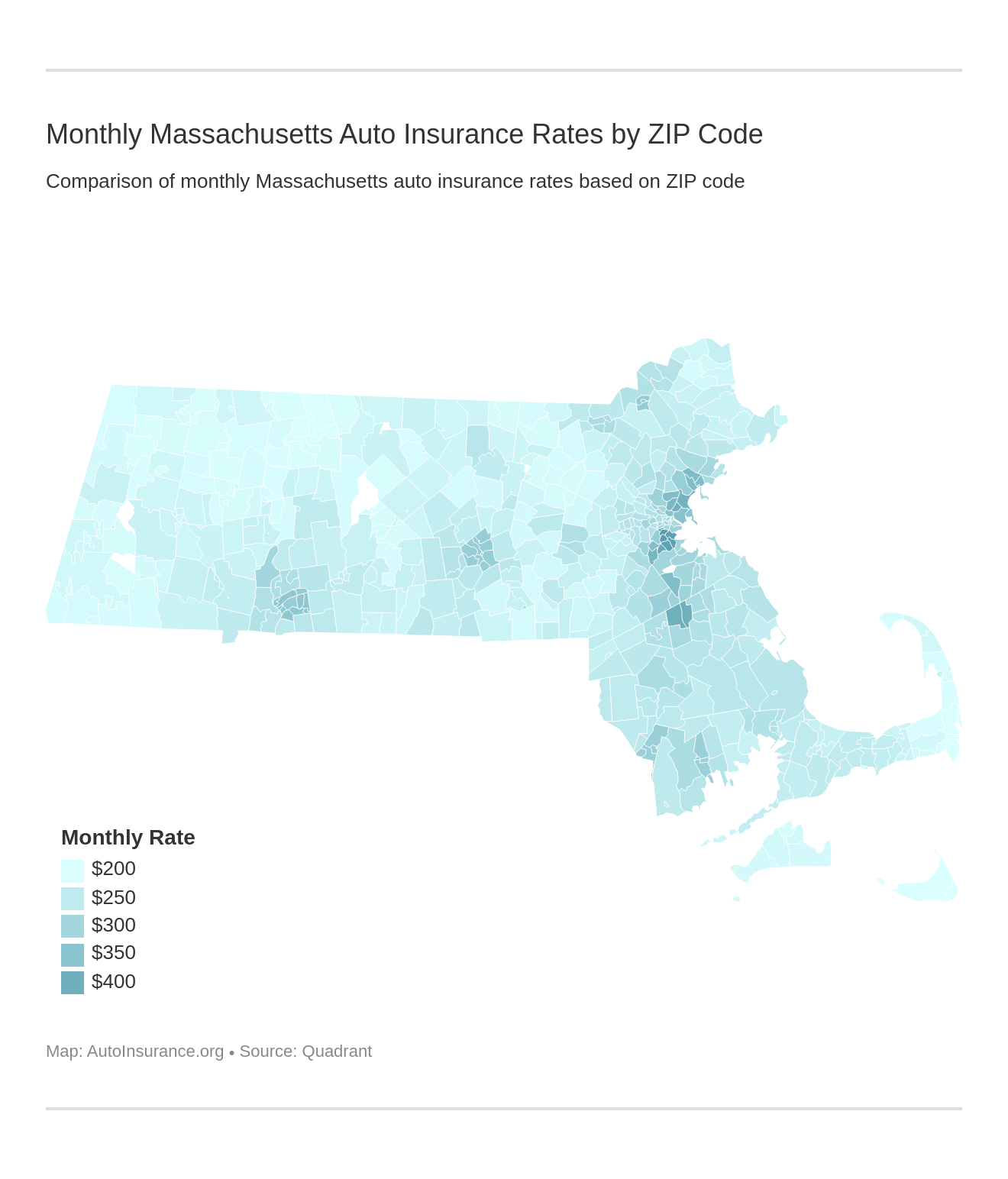

Massachusetts Auto Insurance Quotes Definitive Coverage Guide Autoinsurance Org

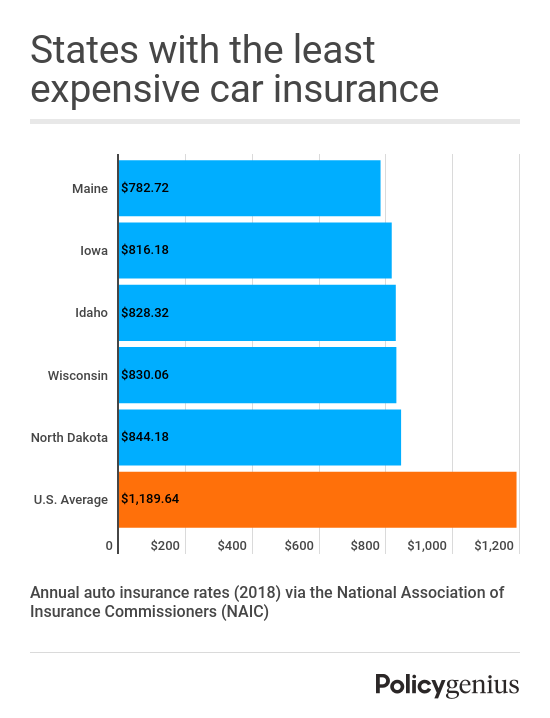

How Much Is Car Insurance Average Car Insurance Cost 2021

Massachusetts Car Insurance Laws Everything You Need To Know

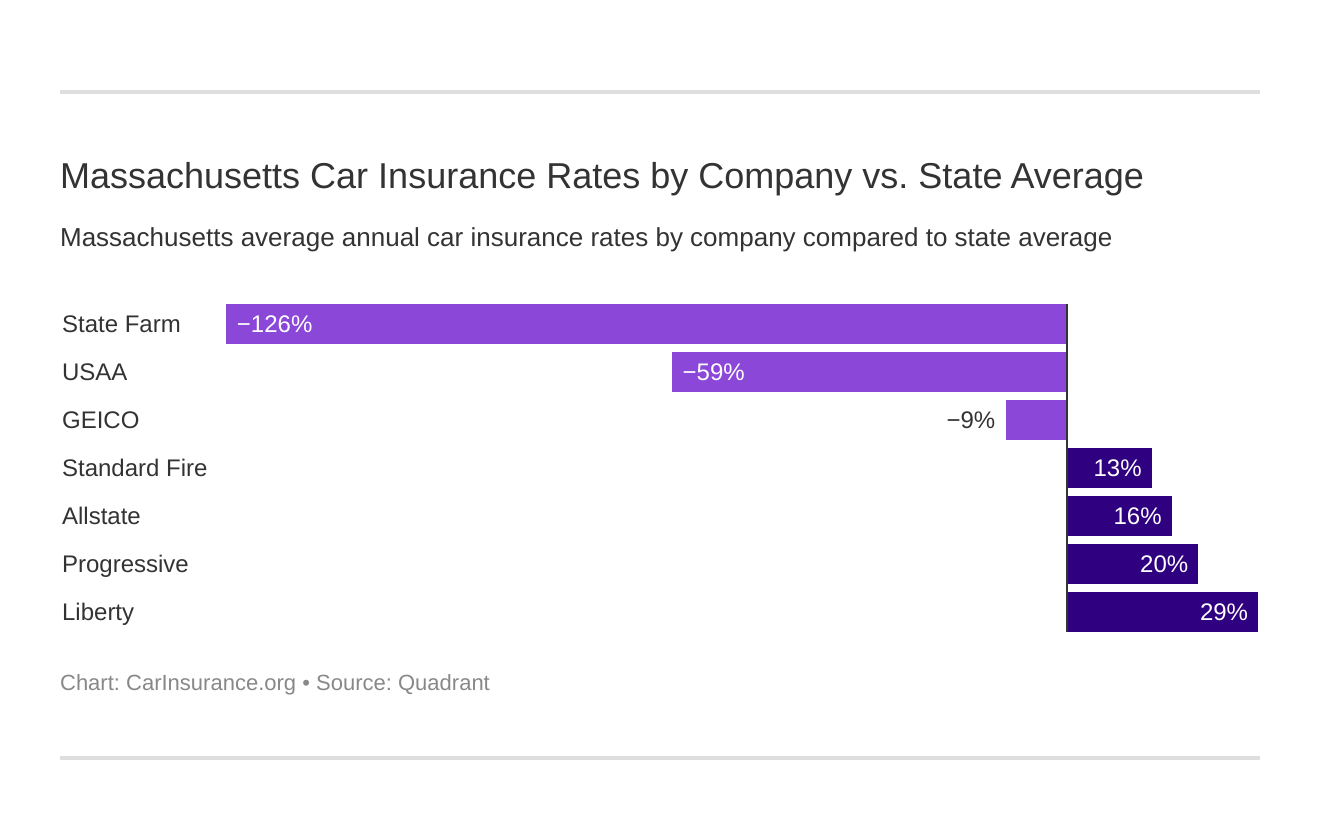

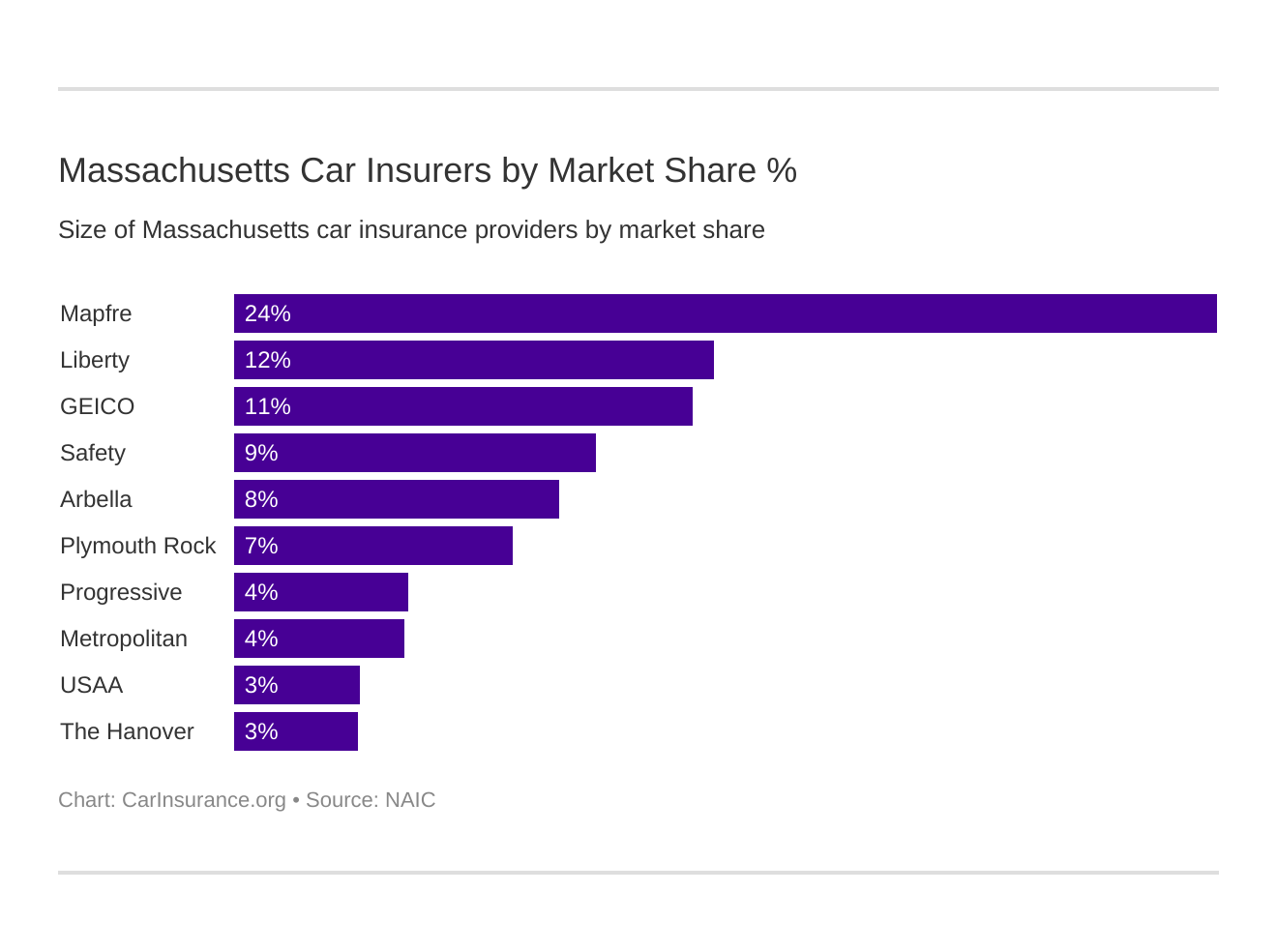

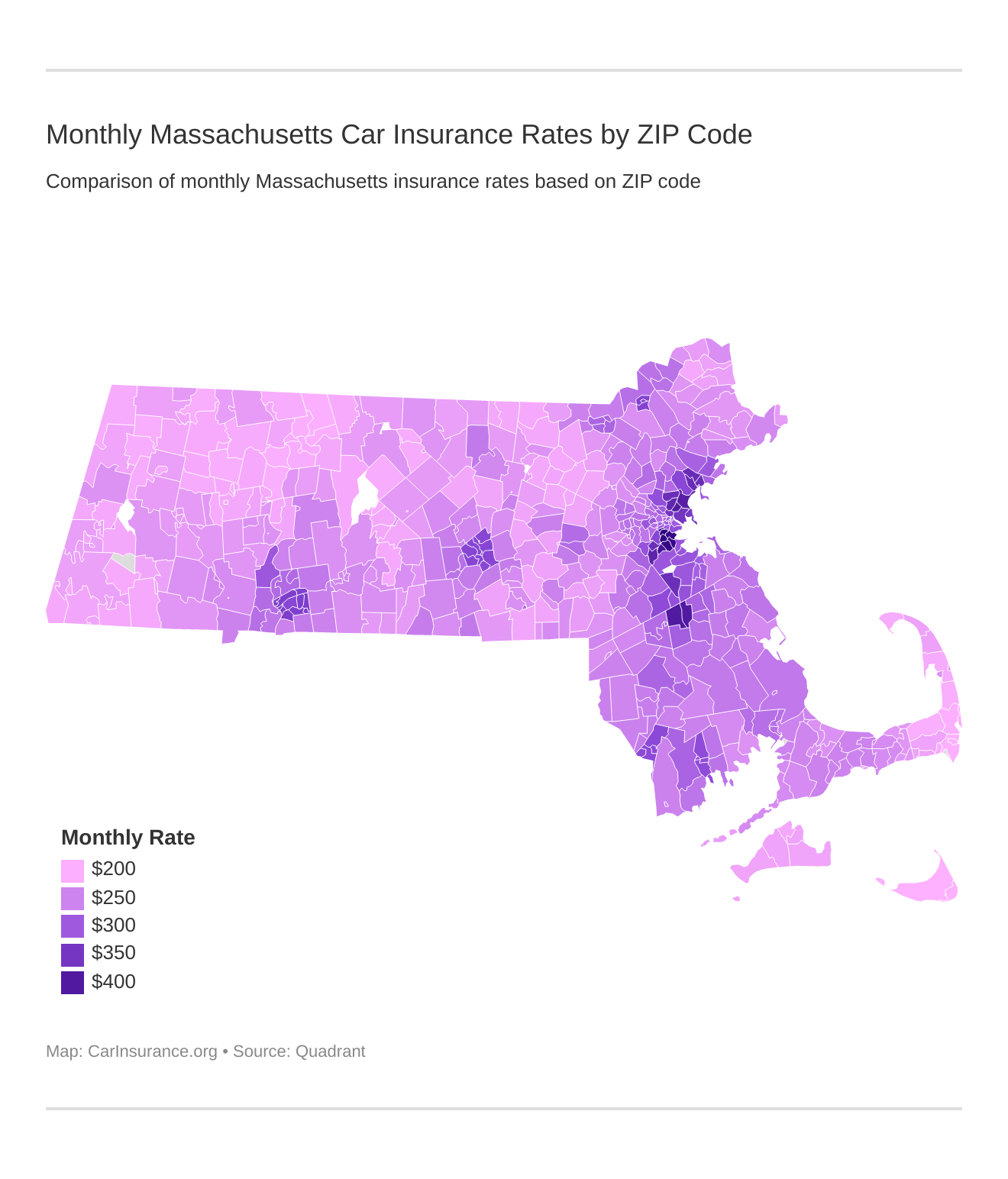

Massachusetts Car Insurance Rates Companies Carinsurance Org

Massachusetts Car Insurance Rates Companies Carinsurance Org

Massachusetts Car Insurance Rates Companies Carinsurance Org

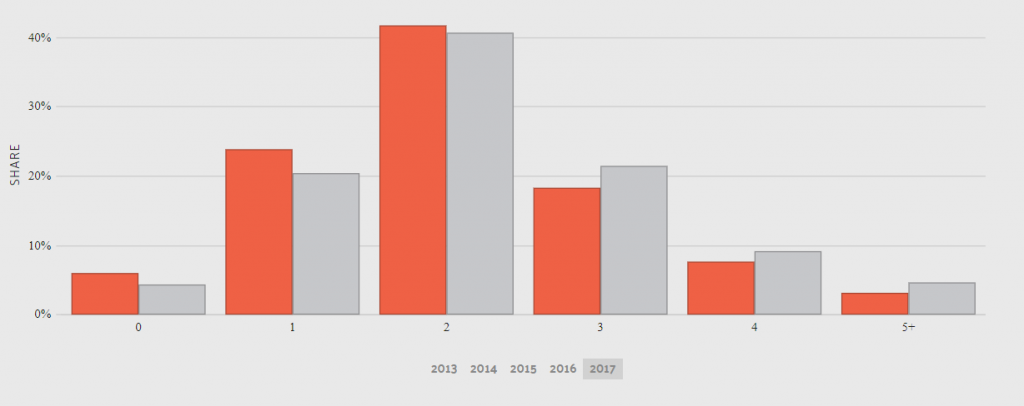

Safe Driver Insurance Plan Sdip And Your Auto Insurance Policy Mass Gov

Do You Need An Auto Insurance Card When Traveling Out Of Ma Berry Insurance

Best Cheap Car Insurance In Massachusetts 2021 Forbes Advisor

What Is Non Owner Car Insurance 2021 Guide

Ten Points To Know About Massachusetts Certification Of Insurance Law Agency Checklists

Massachusetts Auto Insurance Quotes Definitive Coverage Guide Autoinsurance Org

Car Insurance 101 Car Insurance For First Time Drivers

Massachusetts Auto Insurance Quotes Definitive Coverage Guide Autoinsurance Org